- trxn

- Posts

- Slowing inflation, stock markets up and fast delivery firms struggling

Slowing inflation, stock markets up and fast delivery firms struggling

And a productivity framework based on the impact / urgency of task to help you prioritise your tasks for the day

Good morning. If today’s your first trxn email, welcome!

Here are the top 5 stories for British business leaders today:

1) Inflation slows down, leading to smaller anticipated spikes in interest rates

What happened: Inflation as slowed to 7.9% in June from 8.7% in May. This is mostly due to lower food inflation rates (as we reported yesterday) and falling fuel prices. (Read more)

Why it matters: Slowing inflation means that there is less need for the Bank of England to increase the interest rates. This is important as higher interest rates lead to lower business investment and typically lower property prices, which slows economic growth.

2) 10-minute grocery delivery company Getir pulls out of France

What happened: Getir (which also owns Gorillas) and Flink (a Germany super-fast delivery company) have pulled their operations from France. This follows a ruling (in France) that meant their stores could only be classified as ‘warehouses’, rather than ‘shops’. This restricted their ease of locating close to where people live. Getir blamed the pull out from France on ‘difficult economic climate, a hostile regulatory environment and an absence of potential buyers’. (Read more)

Why it matters: These fast-delivery companies have raised significant amounts of money. Overall, the sector employed about 2,200 people in France, so the closing of these companies is significant. With high levels of losses reported by these companies, it remains to be seen whether the concept of super-fast delivery will survive over the next few years.

3) Stock markets jump as housing-related stocks rally

What happened: FTSE 100 up 1.8% and FTSE 250 is up 3.8%. The biggest driver for this was homebuilders, who jumped 7.0% and related stocks such as real estate investment trusts (7.2% increase). The increase was related to the lower than anticipated inflation rate as described in the first story above. (Read more)

Why it matters: The jump marks FTSE 250’s largest single day increase in over 8 months.

4) Luxury brands LVMH and Chanel stocks are down as a result of doubts about China’s economic recovery

What happened: On Monday, Swiss-based Richemont’s stock fell 10.4%, with Hermes 4.2% lower and LVMH down 3.7%. Luxury sales in the US had already been slowing, so the industry had anticipated that China would be the driving force for growth. However, poor economic recovery in China has dampened this forecast. (Read more)

Why it matters: Analysis by BCG showed that the average age of luxury product buyers in China is 28, younger than other major markets across the world. However, with youth unemployment rising to 21.3% in China, it may be hard for these luxury good brands to recruit new customers. This is important for this industry as some brands are already heavily weighted in China - for example Richemont generate 40% of their sales there.

5) Rents increased faster in June than any month since 2016

What happened: Across the UK, rents grew by 5.1%. A broker explained that “rising mortgages, combined with regulatory changes meant rising rents were no surprise”. Meanwhile other brokers said property shortages meant demand was outstripping supply in the rental market. (Read more)

Why it matters: Around 4.6 million houses were privately rented in England in 2021 (Statista). Rental increases therefore affect a significant proportion of the population and also impact people’s ability to spend on other goods and services.

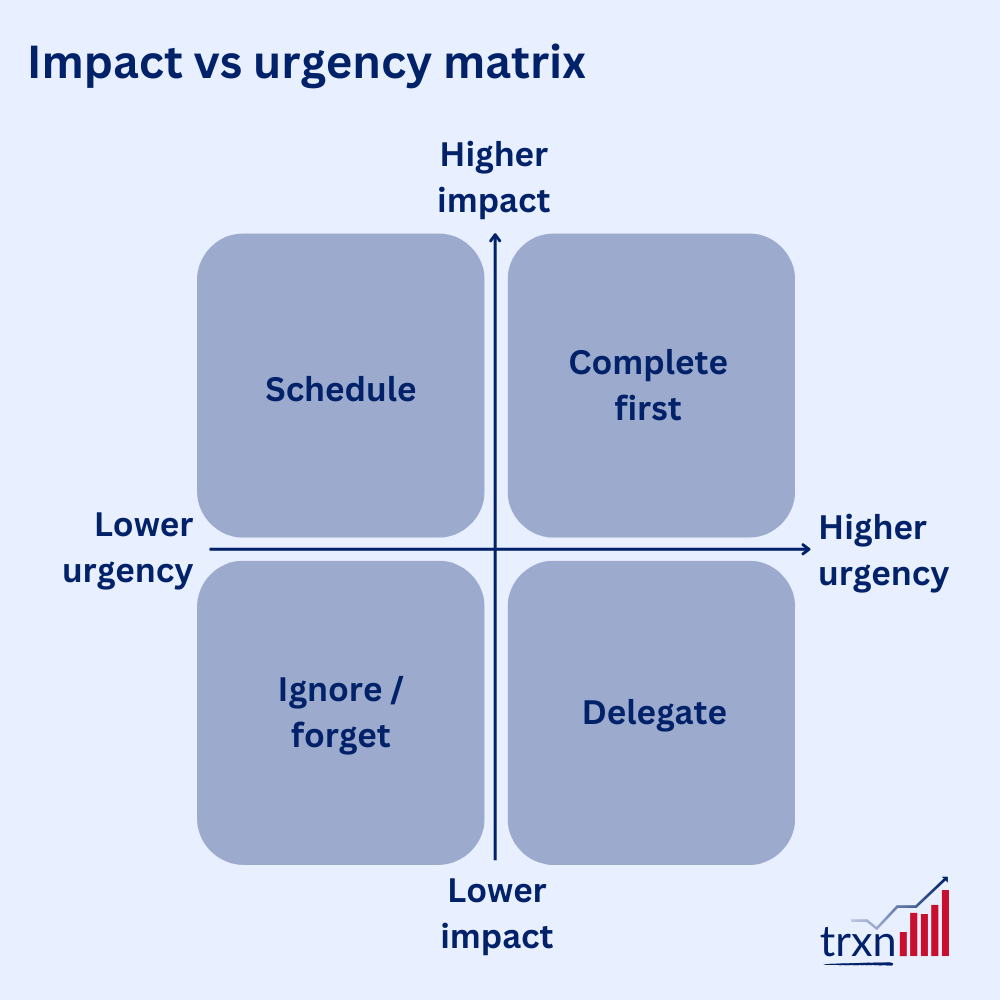

Boost your productivity today, by considering the the impact and urgency of each task on your to-do list

The above matrix gives you a framework for thinking about how you manage your to-do list. It’s applicable to both your work and personal life.

It’s fairly self-explanatory, so I won’t go into too much detail.

However, we need to be clear on what ‘impact’ means to us. This will vary for each person and is task-dependent. One way to think about it is ‘the return on investment’ from undertaking that task. For example, in a business context, a phone call to a potential client who could bring a £1m deal is clearly higher impact than a potential client who could being in £100k.

Urgency is all about time. Think about how long you have to complete the task before it becomes obsolete or non-useful to determine its urgency.

The matrix explains what to do with tasks that fall into each of the buckets. I suggest using it to prioritise your tasks for the day or potentially approaching tasks in a different way by delegating them or even wiping them off your list altogether.