- trxn

- Posts

- Threads hits 100m, Thames Water survives & house prices fall

Threads hits 100m, Thames Water survives & house prices fall

House prices fell at the fastest rate since 2011, whilst Threads became the fastest consumer app to reach 100m users

Good morning and welcome to first ever issue of trxn.

TL;DR

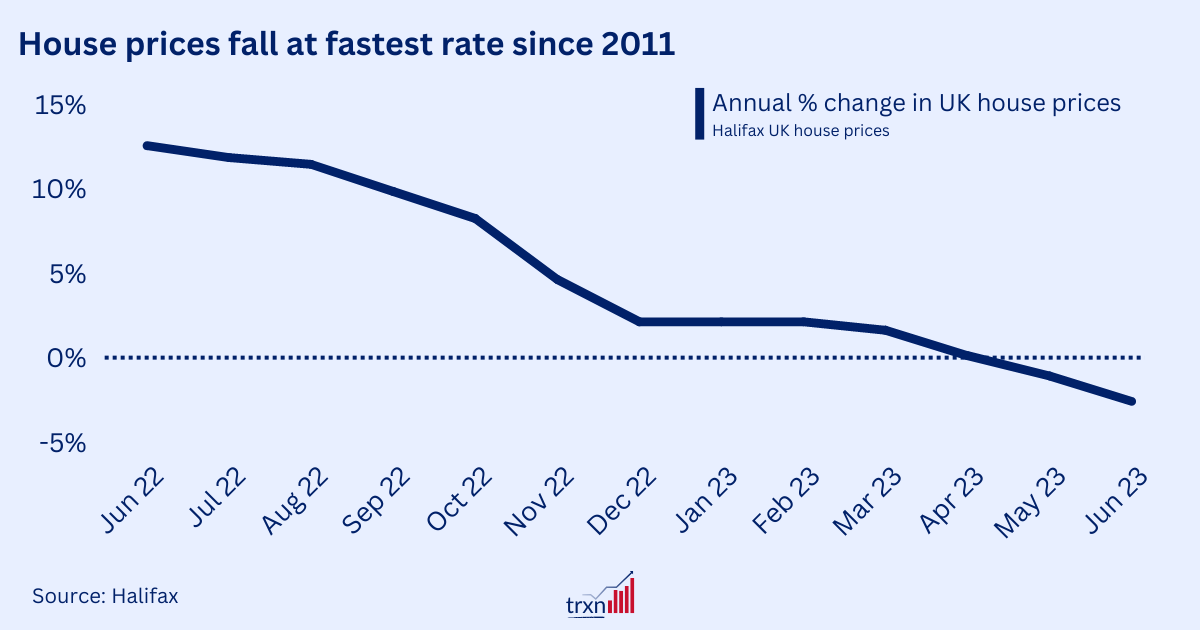

House prices in the UK fell by 2.6% in the year to June 2023.

Thames Water have been thrown a lifeline that will keep them afloat a while longer.

Threads, the Twitter competitor, has become the fastest consumer app to reach 100 million downloads.

House prices decline

After rising at meteoric rates over the past few years, house prices fell by 2.6% (YOY) in the year to June 2023.

On the one hand, this signals that the Bank of England’s attempts to dampen the inflation rate are starting to work.

But on the other hand, as we know from 2008, the market is highly susceptible to falling house prices and this could trigger a decline in the economy.

Thames Water catches a lifeboat

Thames Water successfully raised £750m in funding, saving itself from being placed under the UK government and eventually sold.

Thames Water is the UK’s largest water company, serving 15 million people across London, Oxford, Reading & Swindon.

The company, which is privately owned, has around £14bn in debt. It came into the limelight when it’s ex-boss quit following reports of poor performance with large amounts of sewage leaks and water spills.

The company’s finances have come under scrutiny. For example, it was revealed that during “Macquarie's ownership from 2006 to 2017, Thames paid its investors dividends of 2.7 billion pounds ($3.45 billion) while its debt pile tripled to almost 11 billion pounds.” (Reuters)

The current funding will be sufficient to tide Thames Water through 2023 and much of 2024. They will then seek an extra £2.5bn of funding between 2025 and 2030.

Threads reaches 100 million downloads

Threads, Zuckerberg’s alternative to Twitter, has hit 100 million downloads after having launched only 5 days ago! This brings the app’s total to more than 25% of Twitter’s total active users.

Elon Musk has failed to derail Threads incredible growth despite threatening a lawsuit claiming Meta poached former Twitter staff to build the new social media app (and name calling suck as ‘Zuck is cuck’).

Threads have achieved such mammoth growth by allowing users to link their Threads account to existing Instagram accounts and port over followers. In fact, they’ve broken the record to become the fastest consumer app to reach 100 million users in the history of the internet - smashing ChatGPTs record!

And this is despite limitations such as no DMs, a poor web-based browser experience and no hashtags or keyword search functions.

In achieving such rapid growth, they’ve broken the poor track-record of Twitter copycats. However, to keep things interesting, Jack Dorsey’s very own Twitter alternative, Bluesky, has today surpassed 1 million downloads, despite being ‘invite-only’ at this stage. It remains to be seen who emerges the eventual winner of text-based social media platforms.

UK investment rounds

CAB Payments, who organise cross-border payment flows to and from over 150 countries, lists with £851m valuation on the London Stock Exchange.

Tandem Bank, a UK-based digital bank that’s aiming to help households reduce their carbon footprint, raised £20m in funding.

Chipflow, a startup building an open source design platform for semiconductor chips, today announced the completion of a £1.2M pre-seed round of financing (UK Tech Investment News)

Allye, who turn electric vehicle battery packs into portable energy storage systems, have raised £900,000. Their first product, “The Max”, contains enough storage to power 40 homes a day! (UK Tech News)

Go Eve are making Electric Vehicle charging more efficient by allowing multiple cars to be charged by 1 charge point. An Imperial College spin out, they’ve raised £3m in Series A funding to roll out their technology. (UK Tech News).

Other snippets

Easyjet has axed 1,700 flights to and from Gatwick airport through July, August and September, blaming constrained airspace over Europe and ongoing air traffic control difficulties. They have claimed that 95% of affected passengers have been booked onto other flights.

Bank of England’s Governor, Andrew Bailey, reinforced the central bank’s commitment to raising interest rates to the extent required to bring inflation back to it’s 2% target.

Byju, an ed-tech business once one of India’s hottest start up, has faced operational and financial hardships that have seen its valuation drop from $22bn last year to just $5.1bn this year.

Concept of the day - loss aversion

What it is: Loss aversion stipulates that we experience losses so much more powerfully than we experience gains. The legendary behavioural economists Kahneman and Tversky first coined the term ‘loss aversion’ in 1979.

Take a scenario where you’ll win £100 if a coin lands on head or lose £100 if a coin lands on tails. For the average Joe, the pain from losing £100 is significantly greater than the delight from winning the £100. Therefore, most people would not take that bet. Instead, you’d want odds of winning a lot more than you could potentially lose in order to take on a bet.

Why does it matter and how can I use it: Loss aversion is inbuilt to human psyche and explains why many of us go through life avoiding situations with risks of negative outcomes. However, it can be damaging where it leads to becoming too focussed on negative outcomes that occurred, rather than seeing the positives.

For example, say the football team you support beats a team that we weren’t expecting to beat, but then next week loses to a team you were expecting to beat. It’s likely that you’ll focus and remember the loss significantly more clearly than the win. At this point you should recognise this is just your hunter-gatherer brain trying to help your avoid being eating by a lion. And in doing so, rationalise that you’re team has actually done ok and you can be proud of them for winning the tough match.